As the state motto says, “Labor Conquers All Things”, and Oklahoma is living up to that caveat. Statewide, in Oklahoma, residential building permitting has increased by 3.1% over the first quarter of 2015. The Oklahoma job market is continuing a stable trend with unemployment holding at a respectable 4%, below the national average. Oklahoma home prices are appreciating in many markets, and inventory levels are at 4.8 months. Overall, a testament to perseverance in a state deeply impacted by the oil industry.

Although, a fairly wide-open state, Oklahoma’s major areas are improving. Oklahoma’s second largest city, Tulsa, has seen single-family home sales increase by 1.9% from last month with the median price for the single-family home reaching $139,450.00 which is a 3.3% increase over the previous month. The big winner in Tulsa is the condominium market. Condo median pricing is up 22% to an average of $91,500.00, and existing condo sales have increased by 20%. Tulsa is looking pretty good.

Oklahoma’s most populous city, Oklahoma City, is making marked improvements in the foreclosure indices and sales. Latest figures show properties received for foreclosure in April were 56% lower than those in March and 84% lower than in April of 2015. Oklahoma City’s home sales increased by 32% in April from March sales and a whopping 440% from March 2015. Oklahoma City remains an affordable market with the median price for non-distressed homes is $118,000.00. The median prices of homes in foreclosure is $70,000.00, or 41% lower than the price of a non-distressed home. Foreclosed homes have often presented an opportunity and in Oklahoma City that translates into savings over 40% relative to homes not in foreclosure. With between 1500 and 1700 homes in foreclosure in the city, the opportunity is knocking.

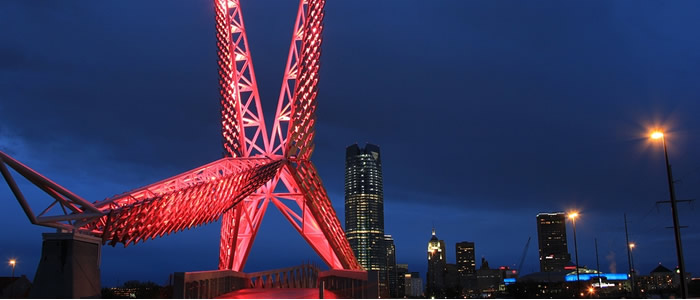

Oklahoma City homes are priced 28% lower the U.S. average and are situated in a place boasting one of the lowest cost of living rates and in one of the safest cities in America. According to Zillow, Oklahoma City currently is the 6th Best Market for the first time home buyer. Oklahoma City offers an attractive picture.

Edmond is a smaller city, the sixth largest in Oklahoma and actively maintaining a reasonably stable market. In Edmond, 85% of the adult population are homeowners. The Edmond inventory of available homes has fallen 13% in the last month, and the average price per square foot is down 6% from 2015. The median price for single-family homes in Edmond from February 19 – May 18, is an affordable $246,000.00. Unlike Oklahoma City, Edmond has reduced their level of distressed homes by 100% with zero homes in foreclosure.

Considering Buying a Home in Oklahoma? We can help get you prequalified.

If you are considering purchasing a piece of residential real estate in Oklahoma, we’d love the opportunity to assist you with your financing needs. At First United Mortgage Group, we offer a variety of home loan products to meet the needs of most home buyers. From conventional loans to government backed FHA and VA mortgage, we can help you explore your options and find a good solution. Call us today at (972) 591-3097 for a free, no obligation consultation.

Story Resources:

http://www.terradatum.com/marketdata/Tulsa/index.html

http://www.realtytrac.com/statsandtrends/ok/oklahoma-county/oklahoma-city/

http://zillow.mediaroom.com/2016-04-27-Indianapolis-and-Pittsburgh-Named-Best-Markets-for-First-Time-Home-Buyers

http://www.trulia.com/real_estate/Edmond-Oklahoma/

Comments are closed.