Increasingly, buyers are opting for newly built homes. While the choice often comes with modern features, energy efficiency, and less maintenance, there’s another reason, value. In today’s market, builders are

DFW is #1 in Workforce Talent Growth

Highly sought-after professionals are choosing Dallas-Fort Worth more than any other large metropolitan area in America. Let’s examine this rising workforce, its ripple effects, and how it impacts buying a

Mortgage Rates Have Dropped – Should You Buy Now?

Rates have fallen recently, giving prospective homebuyers an extra incentive to purchase homes. But is now the right time for you? Let’s consider how the rate change has impacted the

Is It the Right Time to Buy a Home?

The Dallas housing market is in a unique state. Inventory is at a historical high. Prices are softening. Mortgage rates are stable. Let’s consider how these key factors affect the

The Latest on the Dallas Housing Market

Inventory is up, prices are down, and people are moving to Dallas more than almost any other metropolitan area in the country.

More Homes to Choose From

Six months of inventory is

Homebuyer 101: What You Should Know About Down Payments

Potential homebuyers often say saving for a down payment is one of the biggest obstacles to homeownership. But the truth about down payments may be less daunting than many believe.

What

Choosing an Adjustable Rate or a Fixed Rate Mortgage

If you’re planning to buy a home or refinance your current one, choosing between a fixed-rate mortgage and an adjustable-rate mortgage (ARM) is an important decision. Let’s consider the key

Is DFW in a Buyer’s Market?

The Dallas-Fort Worth housing market is shifting as inventory rises, prices soften, and homes spend more time on the market. Let’s look at what this flip from a seller’s to

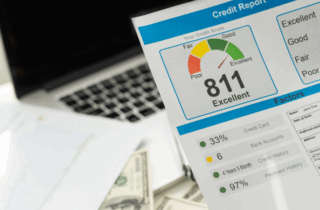

Homebuyer 101: how important is my credit score when buying a home?

Worried a low credit score will slam the door on homeownership? It’s not always the dealbreaker people assume. Let’s consider how your score affects mortgage options and what you should

A New Emerging Trends in Real Estate Report Predicts DFW as the Hottest Market in 2025

Experts predicted it. Now we have proof: DFW has the hottest housing market in the nation. Let’s look at current conditions and what the market may hold in the future.

DFW