The Dallas-Fort Worth housing market is shifting as inventory rises, prices soften, and homes spend more time on the market. Let’s look at what this flip from a seller’s to

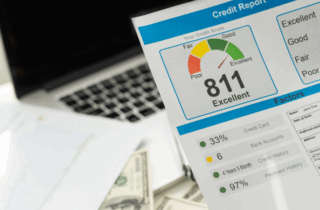

Homebuyer 101: how important is my credit score when buying a home?

Worried a low credit score will slam the door on homeownership? It’s not always the dealbreaker people assume. Let’s consider how your score affects mortgage options and what you should

Homebuyer 101: What is Homeowners Insurance?

Your home is one of your most valuable investments. Homeowners insurance protects that investment, safeguarding your property, belongings, and liability risk. It safeguards your financial future.

What does homeowners insurance protect?

Your

Homebuyer 101: What is Escrow?

About 80% of U.S. mortgage holders have an escrow account. However, these accounts are one of the least understood aspects of home financing. Let’s look at what an escrow account

Looking Ahead to Your Mortgage Payoff? Consider This…

Homeowners can reap significant financial rewards by paying off their mortgages early. Let’s consider the most effective prepayment strategies.

Lump-Sum Prepayments

Unlike monthly payments, one-time lump-sum prepayments go straight toward reducing a

Don’t Overlook These Two Important Expenses When Budgeting for Your New Home

Property taxes and home insurance. They’re probably not at the top of most people’s minds when buying a home, but they should be. Here’s why.

How much will you pay for

How Mortgage Pre-Approvals Can Be a Game-Changer

If you want to know how much house you can afford. If you want an edge over other home buyers. If you want a head start on your home financing,

When Should You Refinance Your Mortgage?

The short answer is simple: when it saves you money. How you save that money and how you might use refinancing for your financial benefit is a little more complicated.

When

New Construction Starter Home Trends

First-time homebuyers often want starter homes. Let’s look at what defines a starter home, who buys them, and the state of the new starter-home market.

The Size of Starter Homes

“Starter homes”

Credit Scores: What Homebuyers Need to Know

A borrower’s credit score often plays a significant role in determining loan type, amount, and terms. Here’s what you need to know.

Minimum Credit Scores

How low can a credit score go