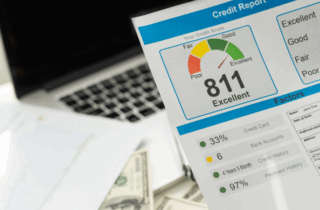

Worried a low credit score will slam the door on homeownership? It’s not always the dealbreaker people assume. Let’s consider how your score affects mortgage options and what you should

Don’t Overlook These Two Important Expenses When Budgeting for Your New Home

Property taxes and home insurance. They’re probably not at the top of most people’s minds when buying a home, but they should be. Here’s why.

How much will you pay for

How Mortgage Pre-Approvals Can Be a Game-Changer

If you want to know how much house you can afford. If you want an edge over other home buyers. If you want a head start on your home financing,

The Real Deal on Down Payments When Buying a House

You’re ready to buy a home, but fear you’ll never save enough money for the down payment. We hear this often from our first-time buyer clients. Let’s dispel some common

Selling Your Home in 2025? Start Planning Now

Have you considered selling your home? Even if you think the property listing is months away, now is the time to prepare. Here’s why and how.

First, focus on the house.

A

What First-Time Home Buyers Need to Know About Closing Costs

You’ve found your dream home and negotiated a good price. But, hold on, that’s not what you’ll pay. There’s an additional set of expenses: closing costs. Let’s look at what

Our Most Commonly Discussed Housing Market Myths

For many, the moment you decide to buy a home is when the myths start flying. From online misinformation to ill-informed friends, there seems to be bad advice everywhere. So,

Jumbo Mortgage Loans Explained

People are taking advantage of today’s attractive interest rates to purchase upscale homes, often using one financing tool: the Jumbo loan. Let’s look at this mortgage option and when it

Understanding Your Down Payment Assistance Options

The down payment is the biggest barrier to home ownership. Or so many believe. A Zillow survey found that about two-thirds of renters in 20 major metropolitan areas think down

Financing for Renovations: Turn Your Forever Home into Your Dream Home

Whether buying a new home or refinancing your current one, you can use Fannie Mae’s HomeStyle® program to cover repairs and improvements. Solar panels. A swimming pool. A new kitchen,