According to real estate analytics firm RealPage, demand for rental apartments reached a five-year high this spring, spurred by new household formation and home sales not being able to keep up. The demand is also pushing rental prices up, which may eventually make renters decide to become home buyers.

“The number of new apartment move-ins in the second quarter of 2019 increased 11% over the same period last year,” says the report. “The demand surge drove the national occupancy rate to 95.8%, compared with 95.4% at the end of the second quarter of 2018.”

The increase was attributed to economic uncertainty in the second quarter that had already slowed the market in the first quarter. RealPage’s chief economist characterized this phenomenon as playing “catch-up.”

Chicago and Houston saw the highest demand in rentals, with move-ins in those markets outpacing apartment construction by nearly 3 to 1, according to the report. With demand comes higher prices, with rentals shooting up 3% from the second quarter of 2018 to the same period this year and many small metros seeing bigger increases. Rents rose 7.4% in Wilmington, N.C., and 6.4% in Huntsville, Ala., according to the report.

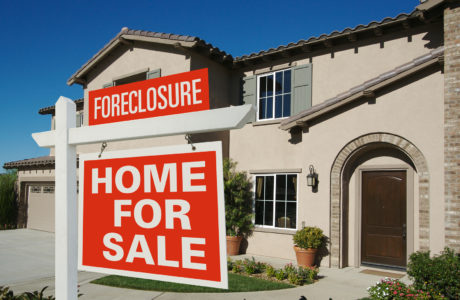

While much of that new supply is targeting higher-income earners, the market for lower-cost rentals is much tighter. The asking price for homes continues to increase, while the cost of procuring a mortgage is at one of its lowest points ever, with income growth being the key in turning the tide as well as more abundant housing opportunities.

Last week, the Trump administration announced it would explore using federal programs to reduce local barriers to housing construction, such as restrictive zoning.

Check back for more housing and real estate news and be sure to connect with us by phone or online if you’re looking for Texas mortgage options. We offer a wide selection of conventional home loans, low money down options, jumbo mortgages and more. Call (972) 591-3097 or reach out to us via our online contact form.

Comments are closed.