With a conventional mortgage, lenders usually want to see a credit score of at least 620. But that’s the floor and the higher the score, the better. Let’s look at some simple ways to raise credit scores.

First, Understand How FICO Scores Work

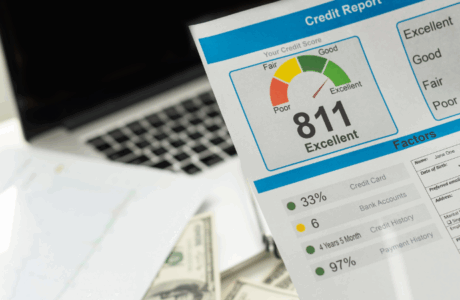

While there are other credit scores, the overwhelming majority of mortgage lenders use FICO, which groups credit data as: payment history (35%), amounts owed (30%), length of credit history (15%), new credit (10%) and credit mix (10%). Now you know which areas to focus on.

Invoke Your Right to Dispute

You should get a copy of your credit report and go over it carefully. If there are any errors – and errors are not uncommon – you have the right to dispute credit report errors with both the credit reporting company and the company that provided the negative information.

Rely on Autopay

As delinquent payments top FICO’s priority list, you don’t want any late payments. One of the best ways to avoid accidental late payments is by setting up automatic transfers from your bank account to credit accounts. Of course you need to ensure there are adequate funds in your account to cover the payments or you could risk costly overdraft fees.

Be Careful With Credit Cards

Even if you always pay your credit cards in full and on time, they could result in strikes against you. That is, if a card has a high credit utilization ratio. For example, if you have a card with a $5,000 limit and $3,000 in purchases, that’s 60% use of available credit. Under 30% is better and under 10% is best. Paying down your credit card is ideal, though you could ask if your credit card company will increase the limit, thus lowering your utilization ratio. Keep in mind that FICO scores look at credit cards individually.

Start Small

Don’t have much credit history? A great way to get started is to take out a credit card with a very small limit. This is easier to get without a strong credit history or score, and if you make a few small charges each month and pay off the balance in full before the due date you will be on your way to establishing credit.

Don’t Rock Your Credit Boat

That means don’t apply for any new loans or new credit cards during the mortgage approval process. When you apply for new credit, lenders usually do a hard credit check that may temporarily lower your credit score.

With freshly boosted credit, you’ll be in a prime position to take advantage of the range of mortgage products offered by the Decker Group at First United Bank Mortgage. Contact us online or call us at (972) 591-3097 to talk about the property you’d like to finance.

Comments are closed.