We all know that buying a home can be a rewarding, but stressful process. It’s likely the biggest financial decision most people will ever make, which understandably puts a lot of pressure on prospective home buyers. The good news, is that most of the common home buying fears can be faced confidently with a little smart planning and education.

We all know that buying a home can be a rewarding, but stressful process. It’s likely the biggest financial decision most people will ever make, which understandably puts a lot of pressure on prospective home buyers. The good news, is that most of the common home buying fears can be faced confidently with a little smart planning and education.

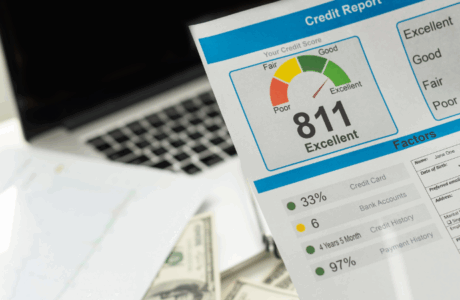

So what are the most common concerns that prospective buyers are currently facing? According to a recent Harris Poll on behalf of Trulia, what has home buyers fretting about the most is whether they will qualify for a mortgage. This is particularly true among millennials – home buyers ages 18 to 34 – who worry about getting access to credit. Credit and income requirements are often seen as hurdles to qualifying for a mortgage, but there are a few options that credit-conscious borrowers should consider.

Although credit requirements can vary between mortgage programs and from lender to lender, there are certain home loan programs that are specifically suited for borrowers with lower credit. FHA loans typically have more lenient credit requirements than conventional loans, making them a popular choice for people with less-than-perfect credit histories. They also have lower down payment requirements, which can benefit new home buyers who may not have a lot of cash saved up for a down payment.

Next on the list of buyer anxieties is being able to find a home they like. With inventory at low levels in many US housing markets, this has becoming a growing concern. Only 35% of Americans say they’ve already purchased their “dream home’ – which means the vast majority are still looking for their ideal home. However, real estate demand is on the rise, which has helped raise home values, and thus made it more appealing for homeowners to put their homes on the market. This scenario will most likely lead to more inventory opening up soon, so hopeful buyers would do well to go ahead and start planning their home buying strategy and researching mortgages now.

Coming in at number three is mortgage rates. Less than half of the people polled said they believed mortgage rates would rise within the next six months. While it’s difficult to say exactly how mortgage rates will change, it’s likely that they will remain at or close to historic lows for a good while. Even if rates rise a bit in the near future, they will still be significantly lower than rates seen in decades past. Also, once you begin the process of securing a mortgage, you can talk with your lender about locking in a low rate, ensuring that you’ll have an affordable rate even if rates go up in the future.

If you have any other concerns about the home buying process, don’t hesitate to speak with a real estate and/or a mortgage professional. Buying a home is a big step, and shouldn’t be done on a whim; however, with the proper knowledge and some careful financial planning, it doesn’t have to be intimidating.

Comments are closed.