In a normal year, this is the time when home sales dip. In a normal year, this is when you can negotiate on getting the price a tad lower, and homes sit on the market longer because of the holidays. In a normal year, winter is typically a time when buyers have the advantage.

This is the winter, however, when all that flies out the window, according to Danielle Hale, Realtor’s chief economist.

“Normally winter is a good time for buyers,” she says, but qualifies it by adding that because the coronavirus pandemic upended normal real estate patterns by keeping buyers at home last spring, it has created a pent-up demand for homes that are only now being felt and felt hard.

“It’s unusual times,” agrees Lawrence Yun, chief economist at the National Association of Realtors. “Normally buyers have a slight edge as homes sit on the market for a longer period. It’s likely to be different this year.”

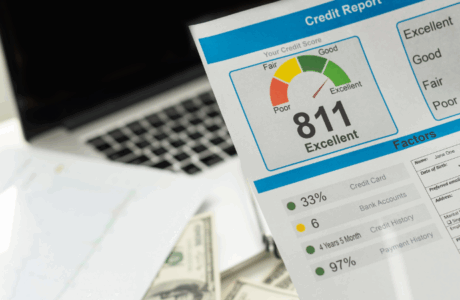

What to expect? For one, fewer homes to choose from than usual. Realtor.com’s Monthly Housing Market Trends Report reports that with more buyers than sellers in the market, homes aren’t lingering on the market for long. In September, homes nationwide spent 12 fewer days on the market than last year, so if you are a buyer, you’ll need to be prepared. That means getting your mortgage pre-approval paperwork in place so you can make an offer fast.

A low inventory market may cause another kind of shift, however. “For one, if coronavirus rates remain low in a community, sellers who’ve been leery about inviting buyers into their home might decide it’s safe enough to give it a try,” says Realtor’s Erica Sweeney. She cites Hale, who says, “Even though inventory will remain low, we could see a slight improvement as sellers gain more confidence in the housing market,” Hale says.

If unemployment rises, more people may be forced to sell their homes. According to the Mortgage Bankers Association, more than 3 million homeowners missed their mortgage payment in September. This means distressed properties may be hitting the market. Add low interest rates to the equation, and you might either reap the rewards in lower house payments or the ability to buy a larger home.

Rare are the times when it could be cheaper—or about the same in the long run — to buy a home rather than pay rent. According to a realtor.com report, in the first quarter of 2020, the median monthly cost to purchase a home was $1,584, compared with $1,391 to rent. That said, prices for renting or buying vary by area, so it’s smart to compare those costs by checking a “rent vs. buy” calculator for your neighborhood and take into account how long you plan to stay put

Comments are closed.