Desire to Own a Home Continues to Increase

Information from the National Association of Realtors shows that the desire to own a home remains strong. Although the share of first time home buyers is disappointing at only 32 percent, the NAR discovered that this could likely change as buyer sentiment makes positive changes and the overall real estate market continues to improve.

Information from the National Association of Realtors shows that the desire to own a home remains strong. Although the share of first time home buyers is disappointing at only 32 percent, the NAR discovered that this could likely change as buyer sentiment makes positive changes and the overall real estate market continues to improve.

In a recent survey, the NAR found a dramatic increase in the share of first time buyers who said their primary reason for becoming a homeowner was the simple desire to own a home.

“There are several reasons why there should be more first-time buyers reaching the market, including persistently low mortgage rates, healthy job prospects for those college-educated, and the fact that renting is becoming more unaffordable in many areas,” said Lawrence Yun, the Realtors’ chief economist. “Unfortunately, there are just as many high hurdles slowing first-time buyers down. Increasing rents and home prices are impeding their ability to save for a down payment, there’s scarce inventory for new and existing-homes in their price range, and it’s still too difficult for some to get a mortgage.”

So what is holding buyers back? According to the NAR survey, debt was cited as the primary reason first time buyers are delaying a purchase. They said debt had created challenges in saving up for a down payment. More than half of those who cited debt as the reason they have not bought a home said student loan debt was the culprit.

Although debt remains a burden for many Americans, the overall sentiment for homeownership has remained positive and has even increased. Sixty-four percent of first-time buyers surveyed said their primary reason for purchasing was the “desire to own.” That is up from 53 percent just one year ago. For repeat buyers, ownership tied with the desire for a larger home. The view of home ownership as a good investment also moved slightly higher to 80 percent; 43 percent of those surveyed said they see housing as a better investment than stocks.

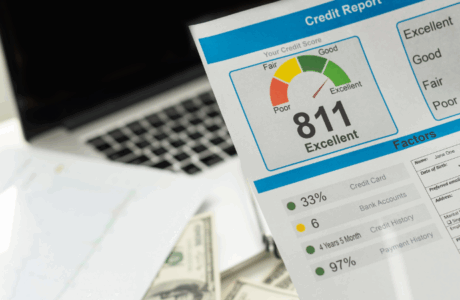

Furthermore, with many lenders easing their credit restrictions and offering low credit mortgage products such as FHA loans, more potential buyers are finding avenues to financing that may not have been available before.

Mortgage Rate Summary

Rates trended slightly better last week, although the market remained extremely volatile.

According to Sigma Research, the recent tragic attacks by ISIS on Paris escalated tension and fear throughout Europe and could possibly have an effect on European economy. However, the savage attacks did not appear to affect the markets here in a substantial way.

In the week ahead, mortgage market experts say the level of volatility will likely remain high.

The Bottom Line

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them. Remember that mortgage rates can be predicted, but not guaranteed. Only if you take the steps to lock in a mortgage are you sure to be set with a rate you’re comfortable with.

Comments are closed.